According to different states, the treatment of Social Security income for food stamps varies. In California, the Food Stamp Program Benefit Once eligibility is established, the net income test applies to both CalWORKs and CalFresh recipients.

Here’s a breakdown of how Social Security is treated for SNAP purposes in different regions:

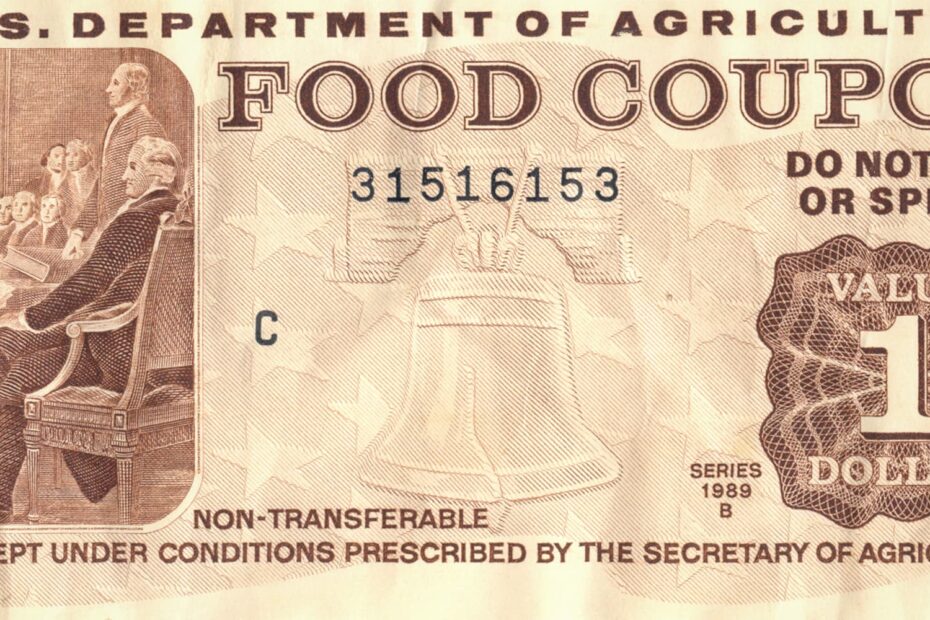

Does Social Security Count as Income for Food Stamps

In California:

Yes, Social Security income (SSI or SSDI) is counted as income when calculating eligibility for CalFresh (California’s SNAP program). The gross monthly amount a household receives in Social Security benefits is included in total household income.

In Texas:

Yes, Social Security benefits are included as income for SNAP eligibility determination in Texas. All forms of unearned income, including SSI/SSDI payments, unemployment insurance, and cash assistance are counted.

In New York:

Social Security disability (SSDI) and retirement benefits are excluded from income calculations for SNAP in New York. However, Supplemental Security Income (SSI) is counted as part of one’s total gross income when applying for food stamps.

In Florida:

Only a portion of Social Security benefits are counted as income for SNAP eligibility in Florida. They exclude $50 from Social Security, SSI or SSDI monthly payment amounts, and the remainder gets added to any other household income sources.

In Illinois:

Yes, Social Security income including retirement benefits, disability payments (SSDI) and Supplemental Security Income (SSI) are considered in aggregate household income determinations for SNAP in Illinois.

In Pennsylvania:

Pennsylvania excludes a portion of Social Security benefits from being counted as income for SNAP eligibility and benefit calculations. The current standard exclusion is $122 per month for 2023. Anything over that amount gets added to total income.

In Ohio:

Ohio excludes $50 of SSI and SSDI payments per recipient when tallying gross monthly income for SNAP eligibility. Social Security old age/retirement pensions are not excluded at all – the full amount counts as unearned income toward food assistance thresholds.

In Arizona:

Only a portion of most Social Security benefits can be excluded in Arizona when calculating income for SNAP eligibility – currently up to $300 per quarter for elderly and disabled applicants. Anything over the quarterly exclusion gets added into total household income.

Here are some helpful resources to find more information about SNAP eligibility in your state:

- USDA Food and Nutrition Service: https://www.fns.usda.gov/

- Benefits.gov: https://www.benefits.gov/

- National Hunger Hotline: 1-866-3-HUNGRY (1-866-348-6479)

Can Seniors on Social Security Get Food Stamps

Yes, seniors who receive Social Security benefits can potentially qualify for food stamps/SNAP benefits, though the amount of Social Security income affects eligibility.

Here are some key details:

Social Security income (retirement benefits, SSDI and SSI) counts towards total household gross income used for SNAP eligibility thresholds.

However, some states like California do allow elderly applicants over age 60 to have higher allowable income limits. This helps more seniors be eligible.

Income exclusions and deductions are also sometimes higher for qualified elderly/disabled households when tallying net monthly income for food stamp tests.

Seniors meeting asset limits and all other SNAP eligibility criteria can get benefits – just reduced amounts if Social Security or pension income is over a minimum threshold.

How Much Food Stamps Will I Get for a Baby

The additional CalFresh (California food stamps) benefits you would receive for a new baby. Benefit amounts are based on household size as well as income, expenses and other eligibility factors.

- Adding a new baby to your household does qualify you to report the change and potentially increase your overall CalFresh monthly allotment.

- Income limits and maximum allotments are higher for larger households with more members/dependents.

- For a 1-person California home, the max CalFresh grant is $243 per month. For a 2-person home it increases to $516 per month.

- You would need to complete paperwork to officially add the baby to your case. Their income (none) and expenses would then be included in benefit calculations.

Also Read : – How Long Does It Take To Get Approved for Tanf